Ahamed says he got the idea for this book when he read a 1999 Time magazine cover story headlined “The Committee to Save the World,” about Alan Greenspan (then the Federal Reserve chairman), Robert Rubin (Bill Clinton’s Treasury Secretary) and Lawrence Summers (Rubin’s No. The lords of finance who constitute the title of this book are the four central bankers who dominated that postwar era: Benjamin Strong of the Federal Reserve Bank of New York Montagu Norman, the longtime head of the Bank of England Émile Moreau of the Banque de France and Hjalmar Schacht, who headed the Reichsbank. “Over 5 million men were looking for work in the United States, another 4.5 million in Germany and 2 million in Britain.”

“Industrial production had fallen 30 percent in the United States, 25 percent in Germany and 20 percent in Britain,” Ahamed writes. A combination of divisive postwar politics, a refusal to abandon economic orthodoxy and a series of policy errors by the world’s four most important central banks - the Federal Reserve, the Bank of England, the German Reichsbank and the Banque de France - had led to the near collapse of capitalist economies in the West. By 1930, when he wrote his essay, the West was in bad shape. The “delicate machine” Keynes referred to was of course the global economy.

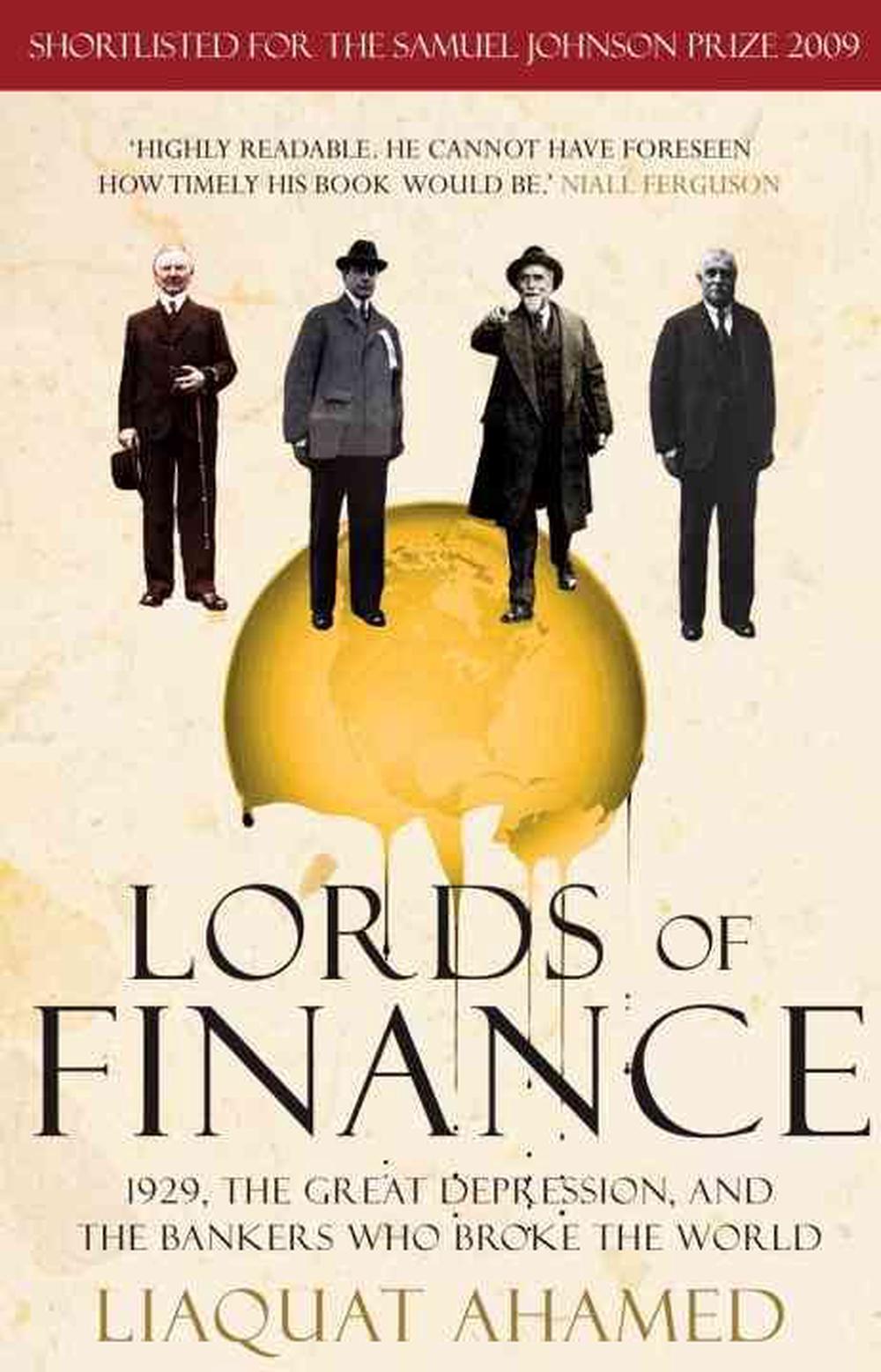

A grand, sweeping narrative of immense scope and power, the book describes a world that long ago receded from memory: the West after World War I, a time of economic fragility, of bubbles followed by busts and of a cascading series of events that led to the Great Depression. I shuddered when I read this quotation in “Lords of Finance,” a magisterial work by Liaquat Ahamed, a veteran hedge fund manager and Brookings Institution trustee. Thirteen months had passed since the crash of 1929 the world was living, in Keynes’s words, in “the shadow of one of the greatest economic catastrophes of modern history.” So wrote the great economic iconoclast John Maynard Keynes in an essay titled “The Great Slump of 1930,” published in December of that year. “We have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand.”

0 kommentar(er)

0 kommentar(er)